The Ultimate Guide To Steve Young Realtor

Wiki Article

Rumored Buzz on Steve Young Realtor

Table of Contents4 Simple Techniques For Steve Young RealtorThe Main Principles Of Steve Young Realtor Steve Young Realtor Can Be Fun For AnyoneSteve Young Realtor Things To Know Before You Buy

For contrast, Wealthfront's ordinary profile gained just under 8% net of charges over the past eight years. As well as the Wealthfront return is much a lot more tax efficient than the return you would certainly get on real estate because of the way returns on your Wealthfront profile are strained and our tax-loss harvesting - steve young realtor.1% return, you need to have a nose for the neighborhoods that are likely to value most quickly and/or discover an awfully mispriced property to get (into which you can invest a tiny amount of cash as well as upgrade right into something that can command a much greater rental fee also better if you can do the work yourself, however you need to ensure you are being appropriately made up for that time).

As well as we're discussing individuals who have big teams to help them discover the optimal home and also make renovations. It's better to expand your financial investments You should think about buying an individual building the very same method you ought to think of an investment in an individual stock: as a huge risk.

The concept of attempting to select the "right" specific residential or commercial property is appealing, particularly when you believe you can get an excellent offer or acquire it with a great deal of leverage. That method can function well in an up market. Nonetheless, 2008 taught everyone concerning the threats of an undiversified realty profile, and reminded us that take advantage of can work both means.

Some Known Questions About Steve Young Realtor.

Liquidity matters The last major disagreement against possessing financial investment residential or commercial properties is liquidity. Unlike a property index fund, you can not sell your residential or commercial property whenever you want. It can be hard to predict for how long it will certainly take for a house to market (as well as it typically feels like the much more eager you are to market, the longer it takes).Trying to earn 3% to 5% more than you would certainly on your index fund is practically difficult except for a handful of property exclusive equity financiers that attract the most effective and the brightest to do only focus on surpassing the market. you could check here Do you truly believe you can do it when professionals can't? Our suggestions on rental property investing is constant with what we encourage on various other non-index financial investments like stock picking and angel investing: if you're mosting likely to do it, treat it as your "play money" and also limit it to 10% of your liquid total assets (as we clarify in Sizing Up Your Residence As A Financial investment, you should not treat your residence as a financial investment, so you don't have to limit your equity in it to 10% of your liquid net worth).

If you possess a property that rents out for less than your bring expense, then I would strongly prompt you to consider selling the home and rather invest in a varied profile of affordable index funds.

For many years, realty financial investment has actually continuously escalated. Some individuals pick to buy a residential or commercial property to lease out on a lasting basis, while others go for short-term leasings for visitors and also webpage company tourists. One location that has actually seen huge growth in genuine estate financial investment is Las Las vega. From houses, single-family homes, and also penthouses to commercial offices as well as retail areas, the city has a vast array of buildings for budding financiers.

More About Steve Young Realtor

Is Las Las vega real estate an excellent investment? That's why the city is continuously coming to be a top actual estate investment location.In between the notorious Strip, the wealth of resorts, resorts, as well as gambling establishments, first-rate entertainment, extraordinary interior tourist attractions, and also impressive outside places, people will constantly be attracted to the city. This indicates you're never ever except visitors looking for a location to remain for a weekend break trip, a lasting leasing, or a home to move to.

These bring in company vacationers and also business owners from all strolls of life that, once more, will certainly be looking for someplace to stay. Having a genuine estate property in the area will be advantageous for them and earn returns for you.

Not known Details About Steve Young Realtor

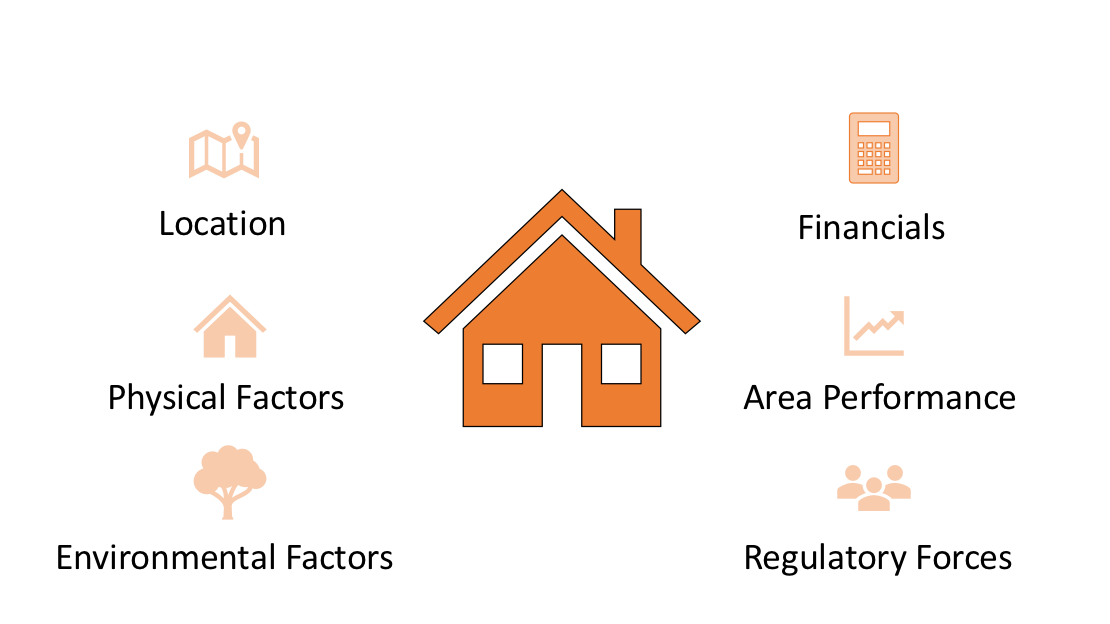

Sort of Residential Property and its Characteristics, It is very important to comprehend what kind of realty residential property you want to invest in business, commercial, domestic, or retail. Residential involves residences, a basic human need, so this investment is recognized to be the safest with ensured returns. The various other 3 have a tendency to have high threats (such as financial recession and also jobs), yet they use higher click to find out more earnings margins.

Report this wiki page